- Details

- Headlines

BRICS & CIS Drive De-dollarization: US Dollar Faces New Global Challenge

The recent strides made by both the BRICS and Commonwealth of Independent States (CIS) in moving towards de-dollarization reflect a significant shift in the global economic order.

With the CIS bloc, comprising 12 countries, now settling 85% of cross-border transactions in local currencies, we are witnessing a monumental development in international trade, one that adds further pressure on the dominance of the US dollar.

Historically, the US dollar has enjoyed its status as the world's reserve currency, a position strengthened by its deep ties to global trade, especially through the petrodollar system—where oil is traded almost exclusively in dollars. This dominance allowed the United States to enjoy unique economic advantages, such as financing its deficits through printing money and exerting significant influence over global financial markets. However, this economic order is now being actively challenged.

Russia, a key driver behind this initiative, has played a pivotal role in convincing the CIS bloc to adopt local currencies for trade. By shifting away from the US dollar, these nations are working to bolster their native economies, fortify their economic independence, and reduce exposure to the fluctuating policies of the US. Russian President Vladimir Putin, speaking at the recent CIS summit, underscored that this movement is rapidly advancing and promises greater technological sovereignty for these nations, particularly as they continue their focus on import substitution.

What does this mean for the future?

1. Impact on the US Dollar's Global Influence

The de-dollarization trend being led by BRICS and now the CIS represents a direct challenge to the US dollar's supremacy. As more nations transition to local currencies for trade, demand for the US dollar may weaken on a global scale. This could, in turn, result in lower demand for US dollar reserves, a shift already observable as US dollar reserves fall below 60%, a threshold not breached since 1995.

Hyperinflation and deficits in the US are possible scenarios if dollar demand declines drastically. The nation has long relied on the global reserve status of its currency to mitigate the impacts of its trade deficits. A significant reduction in global reliance on the dollar would limit this cushion, potentially leading to higher inflation and borrowing costs within the United States.

2. Rise of Regional Economic Collaboration

Both BRICS and the CIS are fostering stronger regional trade ecosystems, which allow for more self-reliant economic frameworks. By reducing dependency on the dollar, these nations can avoid the indirect control exerted by US monetary policy on their economies. It also limits the exposure to sanctions—a tool the US has historically used to exert political influence.

This shift could lead to a new form of economic multipolarity, where regional blocs operate more autonomously. For example, BRICS, which already encompasses some of the world’s largest emerging markets, is promoting a similar agenda, with Russia ensuring that local currency trade becomes the norm. If other regional groups adopt these policies, we could see the emergence of a decentralized financial system, where the global economy is no longer tightly linked to a single dominant currency.

3. Technological and Financial Sovereignty

For Russia and other CIS nations, this move is not only about reducing reliance on the dollar but also about achieving technological sovereignty. By focusing on import substitution and fostering local industries, countries in these alliances are less vulnerable to external supply chain disruptions and foreign sanctions. This trend will likely encourage other nations, particularly in the developing world, to pursue similar strategies to strengthen their own economic resilience.

4. Challenges for the Global Economy

While these de-dollarization efforts benefit the participating nations, they present challenges for the broader global economy. The US dollar has been a stabilizing force in international trade for decades, and a sudden decline in its use could lead to volatility. The transition to a multipolar currency system may require time, coordination, and new financial infrastructure to ensure that international trade continues smoothly without major disruptions.

Conclusion

The move by BRICS and the CIS to settle trade in local currencies rather than the US dollar signals the dawn of a new economic era. It’s a step toward greater financial independence for many countries and a challenge to the longstanding dominance of the US dollar. While the full implications are yet to unfold, this shift will likely accelerate the evolution of a multi-currency world where regional blocs play a larger role in shaping the global financial landscape.

For the US, this movement raises concerns about the potential for increased inflation, trade deficits, and diminished global influence. However, for the CIS and BRICS nations, it represents an opportunity to build stronger, more independent economies that are less tethered to the dollar-dominated financial system. The de-dollarization process is no longer speculative—it’s happening, and its effects will reshape global trade for decades to come.

- Details

- News Team

- Hits: 1730

Local News

- Details

- Society

Kribi II: Man Caught Allegedly Abusing Child

- News Team

- 14.Sep.2025

- Details

- Society

Back to School 2025/2026 – Spotlight on Bamenda & Nkambe

- News Team

- 08.Sep.2025

- Details

- Society

Cameroon 2025: From Kamto to Biya: Longue Longue’s political flip shocks supporters

- News Team

- 08.Sep.2025

- Details

- Society

Meiganga bus crash spotlights Cameroon’s road safety crisis

- News Team

- 05.Sep.2025

EditorialView all

- Details

- Editorial

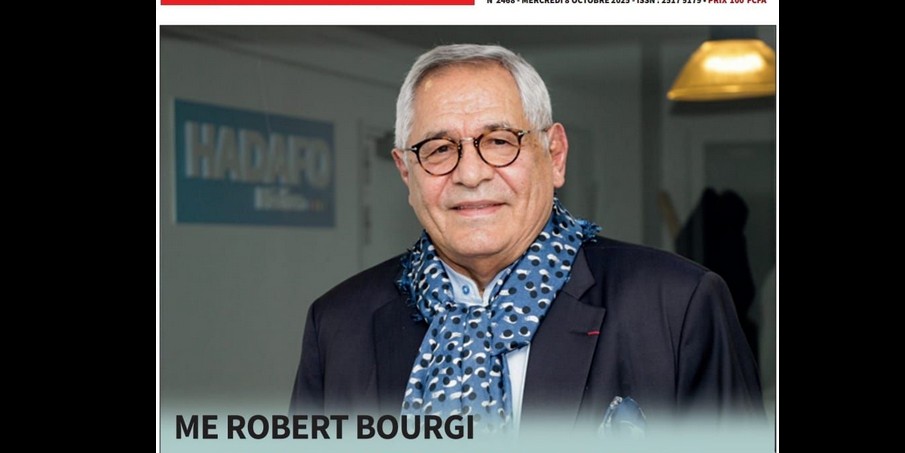

Robert Bourgi Turns on Paul Biya, Declares Him a Political Corpse

- News Team

- 10.Oct.2025

- Details

- Editorial

Heat in Maroua: What Biya’s Return Really Signals

- News Team

- 08.Oct.2025

- Details

- Editorial

Issa Tchiroma: Charles Mambo’s “Change Candidate” for Cameroon

- News Team

- 11.Sep.2025

- Details

- Editorial