Editorial

- Details

- Editorial

Legitimate satisfaction characterised the various speakers who took the floor yesterday 29 October 2015 to highlight the way forward for both India and Africa as they design a new road map for mutual cooperation in the interest of their peoples. The inaugural ceremony which saw the Indian Prime Minister Narendra Modi, his co-chair of the event President Robert Mugabe who is the current President of the African Union as well as Mrs Zuma, Chairperson of the African Union Commission and the Minister of External Affairs of India, Shusma Swaraj all underscored the shared goals between Africa and India. Opening remarks by the Indian Minister of External Affairs were just to usher in the main speakers for the morning. The Summit Chairperson, Prime Minister, made a hair-raising declaration to send home his points. Having overcome the challenges of colonialism, neo-colonial and apartheid, Africa and India, he said could no longer afford to remain behind. He recalled the adage that, “if you want to go quickly, go alone, if you want to go far, go with others.” Saying India and Africa must go far since they had much in common.

He welcome the brilliant colours of Africa and India blending together grate names like Gandhi, Mandela etc. a vibrant mosaic of languages, religious and cultural ties now linked by the Indian Ocean, ties of kingship commerce united through centuries saying their presence of African leaders in India symbolised one third of humanity under one roof, in the same rhythm A people who have cough for their liberty and dignity, spoken in one voice in the world and formed a partnership of prosperity, He insisted that their youth constituted another precious element that united them and African like India now coming together to take responsibility for their development should be an unmistaken sign.

PM Modi visited the multitude of exhibitions at the Indira Gandhi Sport Complex that exalted creative talents endowed in Africa and India. The same messages were highlighted by President Robert Mugabe of Zimbabwe, and Mrs Zuma as well as the 39 Heads of State, Prime Ministers and Vice Presidents that led delegations to New Delhi for the Summit. The leaders lauded the role of Prime Minister Modi in boasting cooperation ties with Africa and the various scholarships, and capacity building offers that India is making to Africa. Some appreciated the specific development and investment opportunities that their countries are currently undertaking with India. A huge highway for mutual advances is therefore being opened between Africa and India with the youth being placed at the centre following chances for education, technological improvements and other refresher courses that can help them leverage for a better future.

- Details

- Ngwa Bertrand

- Hits: 1170

- Details

- Editorial

Legitimate satisfaction characterised the various speakers who took the floor yesterday 29 October 2015 to highlight the way forward for both India and Africa as they design a new road map for mutual cooperation in the interest of their peoples. The inaugural ceremony which saw the Indian Prime Minister Narendra Modi, his co-chair of the event President Robert Mugabe who is the current President of the African Union as well as Mrs Zuma, Chairperson of the African Union Commission and the Minister of External Affairs of India, Shusma Swaraj all underscored the shared goals between Africa and India. Opening remarks by the Indian Minister of External Affairs were just to usher in the main speakers for the morning. The Summit Chairperson, Prime Minister, made a hair-raising declaration to send home his points. Having overcome the challenges of colonialism, neo-colonial and apartheid, Africa and India, he said could no longer afford to remain behind. He recalled the adage that, “if you want to go quickly, go alone, if you want to go far, go with others.” Saying India and Africa must go far since they had much in common.

He welcome the brilliant colours of Africa and India blending together grate names like Gandhi, Mandela etc. a vibrant mosaic of languages, religious and cultural ties now linked by the Indian Ocean, ties of kingship commerce united through centuries saying their presence of African leaders in India symbolised one third of humanity under one roof, in the same rhythm A people who have cough for their liberty and dignity, spoken in one voice in the world and formed a partnership of prosperity, He insisted that their youth constituted another precious element that united them and African like India now coming together to take responsibility for their development should be an unmistaken sign.

PM Modi visited the multitude of exhibitions at the Indira Gandhi Sport Complex that exalted creative talents endowed in Africa and India. The same messages were highlighted by President Robert Mugabe of Zimbabwe, and Mrs Zuma as well as the 39 Heads of State, Prime Ministers and Vice Presidents that led delegations to New Delhi for the Summit. The leaders lauded the role of Prime Minister Modi in boasting cooperation ties with Africa and the various scholarships, and capacity building offers that India is making to Africa. Some appreciated the specific development and investment opportunities that their countries are currently undertaking with India. A huge highway for mutual advances is therefore being opened between Africa and India with the youth being placed at the centre following chances for education, technological improvements and other refresher courses that can help them leverage for a better future.

- Details

- Ngwa Bertrand

- Hits: 1302

- Details

- Editorial

It is five years now since the bank created to boost agricultural activities in the country was announced. Cameroonian farmers are certainly taken aback to see that such a long period has elapse without any possibility of them rushing to the bank to get the necessary finances to fund their activities. As the days pass by, hopes are rekindled with the setting up of the structures therein to enable the bank effectively go operational. The bank’s administration has been set up and the initial capital put in place to enable the institution functional. But on the ground, nothing has changed.

This state of affairs has been troubling Cameroonians, considering that agriculture represents more than half of the country’s non-oil export revenue and employs almost 60 per cent of the working population. Ninety per cent of rural households are, in one way or another, employed in agriculture, and approximately one-third of them earn their living from export crops. The announcement by the Chamber of Agriculture, Fisheries, Livestock and Forestry of the setting up of microfinance in charge of supporting farmers and ensuring their social security is another welcome initiative.

Farmers, in effect, received the news with mixed feeling especially as they haven’t been able to reap the fruit of the much pampered agriculture bank. In any case, they have continued to operate within their historic precincts financing their activities with their meagre savings, Njangis, contributions, common initiative groups and cooperative societies. In addition, pending the effective functioning of the agricultural bank and the microfinance institutions, government has not stopped providing subventions to farmers through their various cooperatives and other groups. This is being done through the various projects in the Ministry of Agriculture and Rural Development. Some of them include: projects in charge of in-puts such as fertilizers, chemicals (insecticides, herbicides, fungicides) and seedlings. But this has not been enough to solve the problem.

Agriculture, it should be recalled, is more of a private sector economic activity. Government’s action should in the real sense constitute assistance. Unfortunately, many Cameroonians continue to think that government must play a primordial role in developing the sector. This entails that the creation of financial institutions ought not to be the sole source of funding for many a farmer. That said, local financial institutions of the private sector have not been of great assistance to the agric sector. Commercial banks for instance, continue to see agriculture as a highly risky sector and so, are not ready to give out loans to farmers. The conditions remain draconian. And whenever such loans do come in, there is sometimes lack of follow up to ensure that such projects are effectively implemented. It is not the first time a bank is being created to promote agriculture in Cameroon.

The faith of the Rural Development Fund (FONADER) remains engraved in many minds. Created for farmers, the bank became a financial haven for the well-to-do. At the end of the day, loans were disbursed to people who were neither agriculturalists nor potential ones. The announcement of another bank brought back minds to the woes of FONADER and this explains why many continue to think and wish that the slow takeoff of the new structure should be a measure to avoid the errors of the past.

- Details

- Ngwa Bertrand

- Hits: 1588

- Details

- Editorial

It is five years now since the bank created to boost agricultural activities in the country was announced. Cameroonian farmers are certainly taken aback to see that such a long period has elapse without any possibility of them rushing to the bank to get the necessary finances to fund their activities. As the days pass by, hopes are rekindled with the setting up of the structures therein to enable the bank effectively go operational. The bank’s administration has been set up and the initial capital put in place to enable the institution functional. But on the ground, nothing has changed.

This state of affairs has been troubling Cameroonians, considering that agriculture represents more than half of the country’s non-oil export revenue and employs almost 60 per cent of the working population. Ninety per cent of rural households are, in one way or another, employed in agriculture, and approximately one-third of them earn their living from export crops. The announcement by the Chamber of Agriculture, Fisheries, Livestock and Forestry of the setting up of microfinance in charge of supporting farmers and ensuring their social security is another welcome initiative.

Farmers, in effect, received the news with mixed feeling especially as they haven’t been able to reap the fruit of the much pampered agriculture bank. In any case, they have continued to operate within their historic precincts financing their activities with their meagre savings, Njangis, contributions, common initiative groups and cooperative societies. In addition, pending the effective functioning of the agricultural bank and the microfinance institutions, government has not stopped providing subventions to farmers through their various cooperatives and other groups. This is being done through the various projects in the Ministry of Agriculture and Rural Development. Some of them include: projects in charge of in-puts such as fertilizers, chemicals (insecticides, herbicides, fungicides) and seedlings. But this has not been enough to solve the problem.

Agriculture, it should be recalled, is more of a private sector economic activity. Government’s action should in the real sense constitute assistance. Unfortunately, many Cameroonians continue to think that government must play a primordial role in developing the sector. This entails that the creation of financial institutions ought not to be the sole source of funding for many a farmer. That said, local financial institutions of the private sector have not been of great assistance to the agric sector. Commercial banks for instance, continue to see agriculture as a highly risky sector and so, are not ready to give out loans to farmers. The conditions remain draconian. And whenever such loans do come in, there is sometimes lack of follow up to ensure that such projects are effectively implemented. It is not the first time a bank is being created to promote agriculture in Cameroon.

The faith of the Rural Development Fund (FONADER) remains engraved in many minds. Created for farmers, the bank became a financial haven for the well-to-do. At the end of the day, loans were disbursed to people who were neither agriculturalists nor potential ones. The announcement of another bank brought back minds to the woes of FONADER and this explains why many continue to think and wish that the slow takeoff of the new structure should be a measure to avoid the errors of the past.

- Details

- Ngwa Bertrand

- Hits: 1355

- Details

- Editorial

It is five years now since the bank created to boost agricultural activities in the country was announced. Cameroonian farmers are certainly taken aback to see that such a long period has elapse without any possibility of them rushing to the bank to get the necessary finances to fund their activities. As the days pass by, hopes are rekindled with the setting up of the structures therein to enable the bank effectively go operational. The bank’s administration has been set up and the initial capital put in place to enable the institution functional. But on the ground, nothing has changed.

This state of affairs has been troubling Cameroonians, considering that agriculture represents more than half of the country’s non-oil export revenue and employs almost 60 per cent of the working population. Ninety per cent of rural households are, in one way or another, employed in agriculture, and approximately one-third of them earn their living from export crops. The announcement by the Chamber of Agriculture, Fisheries, Livestock and Forestry of the setting up of microfinance in charge of supporting farmers and ensuring their social security is another welcome initiative.

Farmers, in effect, received the news with mixed feeling especially as they haven’t been able to reap the fruit of the much pampered agriculture bank. In any case, they have continued to operate within their historic precincts financing their activities with their meagre savings, Njangis, contributions, common initiative groups and cooperative societies. In addition, pending the effective functioning of the agricultural bank and the microfinance institutions, government has not stopped providing subventions to farmers through their various cooperatives and other groups. This is being done through the various projects in the Ministry of Agriculture and Rural Development. Some of them include: projects in charge of in-puts such as fertilizers, chemicals (insecticides, herbicides, fungicides) and seedlings. But this has not been enough to solve the problem.

Agriculture, it should be recalled, is more of a private sector economic activity. Government’s action should in the real sense constitute assistance. Unfortunately, many Cameroonians continue to think that government must play a primordial role in developing the sector. This entails that the creation of financial institutions ought not to be the sole source of funding for many a farmer. That said, local financial institutions of the private sector have not been of great assistance to the agric sector. Commercial banks for instance, continue to see agriculture as a highly risky sector and so, are not ready to give out loans to farmers. The conditions remain draconian. And whenever such loans do come in, there is sometimes lack of follow up to ensure that such projects are effectively implemented. It is not the first time a bank is being created to promote agriculture in Cameroon.

The faith of the Rural Development Fund (FONADER) remains engraved in many minds. Created for farmers, the bank became a financial haven for the well-to-do. At the end of the day, loans were disbursed to people who were neither agriculturalists nor potential ones. The announcement of another bank brought back minds to the woes of FONADER and this explains why many continue to think and wish that the slow takeoff of the new structure should be a measure to avoid the errors of the past.

- Details

- Ngwa Bertrand

- Hits: 1248

- Details

- Editorial

It is five years now since the bank created to boost agricultural activities in the country was announced. Cameroonian farmers are certainly taken aback to see that such a long period has elapse without any possibility of them rushing to the bank to get the necessary finances to fund their activities. As the days pass by, hopes are rekindled with the setting up of the structures therein to enable the bank effectively go operational. The bank’s administration has been set up and the initial capital put in place to enable the institution functional. But on the ground, nothing has changed.

This state of affairs has been troubling Cameroonians, considering that agriculture represents more than half of the country’s non-oil export revenue and employs almost 60 per cent of the working population. Ninety per cent of rural households are, in one way or another, employed in agriculture, and approximately one-third of them earn their living from export crops. The announcement by the Chamber of Agriculture, Fisheries, Livestock and Forestry of the setting up of microfinance in charge of supporting farmers and ensuring their social security is another welcome initiative.

Farmers, in effect, received the news with mixed feeling especially as they haven’t been able to reap the fruit of the much pampered agriculture bank. In any case, they have continued to operate within their historic precincts financing their activities with their meagre savings, Njangis, contributions, common initiative groups and cooperative societies. In addition, pending the effective functioning of the agricultural bank and the microfinance institutions, government has not stopped providing subventions to farmers through their various cooperatives and other groups. This is being done through the various projects in the Ministry of Agriculture and Rural Development. Some of them include: projects in charge of in-puts such as fertilizers, chemicals (insecticides, herbicides, fungicides) and seedlings. But this has not been enough to solve the problem.

Agriculture, it should be recalled, is more of a private sector economic activity. Government’s action should in the real sense constitute assistance. Unfortunately, many Cameroonians continue to think that government must play a primordial role in developing the sector. This entails that the creation of financial institutions ought not to be the sole source of funding for many a farmer. That said, local financial institutions of the private sector have not been of great assistance to the agric sector. Commercial banks for instance, continue to see agriculture as a highly risky sector and so, are not ready to give out loans to farmers. The conditions remain draconian. And whenever such loans do come in, there is sometimes lack of follow up to ensure that such projects are effectively implemented. It is not the first time a bank is being created to promote agriculture in Cameroon.

The faith of the Rural Development Fund (FONADER) remains engraved in many minds. Created for farmers, the bank became a financial haven for the well-to-do. At the end of the day, loans were disbursed to people who were neither agriculturalists nor potential ones. The announcement of another bank brought back minds to the woes of FONADER and this explains why many continue to think and wish that the slow takeoff of the new structure should be a measure to avoid the errors of the past.

- Details

- Ngwa Bertrand

- Hits: 1591

Local News

- Details

- Society

Kribi II: Man Caught Allegedly Abusing Child

- News Team

- 14.Sep.2025

- Details

- Society

Back to School 2025/2026 – Spotlight on Bamenda & Nkambe

- News Team

- 08.Sep.2025

- Details

- Society

Cameroon 2025: From Kamto to Biya: Longue Longue’s political flip shocks supporters

- News Team

- 08.Sep.2025

- Details

- Society

Meiganga bus crash spotlights Cameroon’s road safety crisis

- News Team

- 05.Sep.2025

EditorialView all

- Details

- Editorial

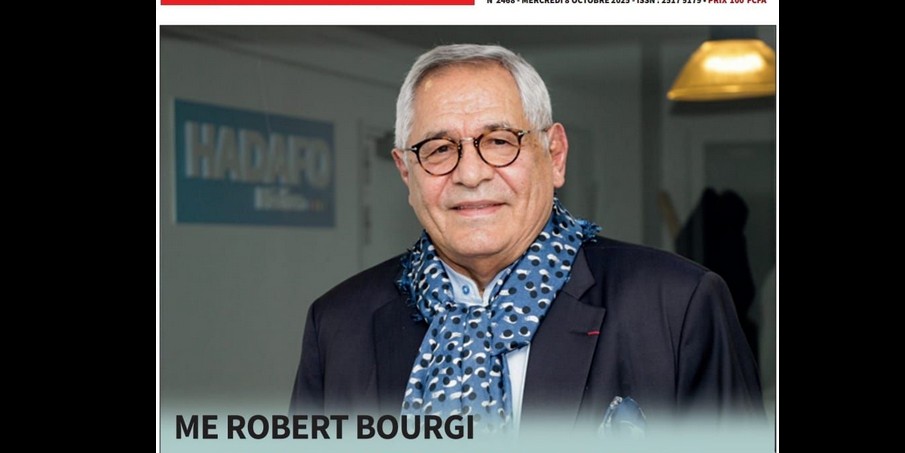

Robert Bourgi Turns on Paul Biya, Declares Him a Political Corpse

- News Team

- 10.Oct.2025

- Details

- Editorial

Heat in Maroua: What Biya’s Return Really Signals

- News Team

- 08.Oct.2025

- Details

- Editorial

Issa Tchiroma: Charles Mambo’s “Change Candidate” for Cameroon

- News Team

- 11.Sep.2025

- Details

- Editorial